Important: The following information pertains to US QuickBooks Online installs only. For Canada, UK, and Australia, please click on the corresponding topic. |

Sales Tax Tab

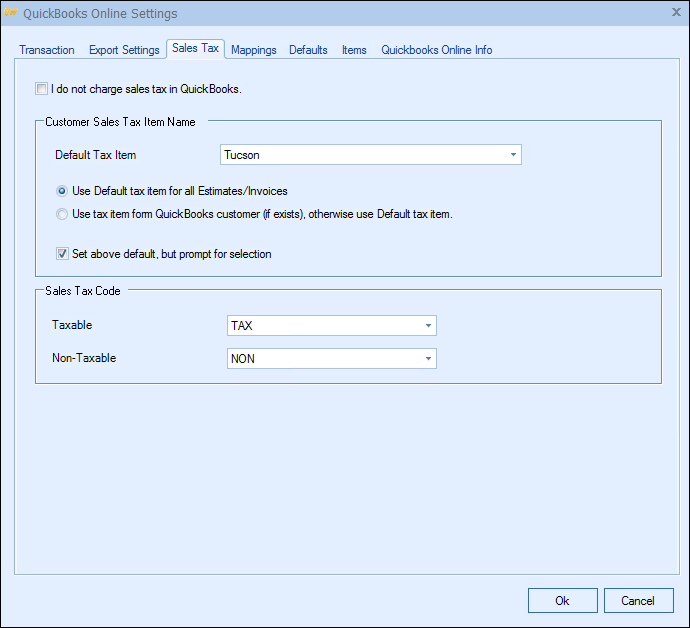

This tab is where users can specify their default tax settings for QuoteWerks to QuickBooks Online.

The following settings are for US users only. For other countries please see those specific topics:

I do not charge sales tax in QuickBooks

Check this box if you do not collect or charge sales tax in QuickBooks.

Customer Sales Tax Item Name

The sales tax item is used to specify which sales tax rate your customer should be charged. In QuickBooks you can set up different sales tax items to reflect the different tax zones. Most companies only need one zone (their own). Example; ABC Company is based in Tucson, so we called the sales tax item “Tucson”.

Default Tax Item

When exporting estimates/invoices to QuickBooks, you will need to specify a Sales Tax Item Name that determines the tax rate for the estimate/invoice. This is the QuickBooks tax item that will be used by default.

Use default tax item for all Estimates/Invoices

Choose this option to use the default tax item no matter what tax item is specified for the customer in QuickBooks.

Use tax item from QuickBooks customer (if exists), otherwise use Default tax item

Choose this option to use the tax item (and therefore tax rate) that you have setup for the customer in QuickBooks. This can only be done if the customer that you are creating the estimate/invoice for already exists in QuickBooks.

Set above default, but Prompt for selection

Check this option to be able to review the tax name/rate that will be used before proceeding.

Sales Tax Codes

In the USA items are either Taxable or Non-Taxable. Because QuickBooks uses tax codes, you will need to tell QuoteWerks which QuickBooks tax code to use for a Taxable item and which to use for a Non-Taxable item.

For instructions on the next topic, view the Mappings tab.

Related Topics: