|

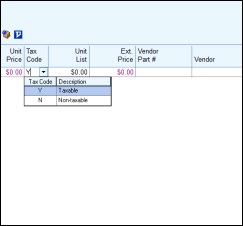

When creating a quote and adding products and services to the quote, you’ll see a Tax Code column in the Quote Workbook. This column displays the tax code being used for that particular line item. If you click in that column for a line item, a drop-down box will appear for you to select the appropriate tax code.

In the Tax Code column for each line item, you can type the tax code of "Y" for taxable or "N" for non-taxable. You can also choose either option from the Tax Code drop-down box.

You can also set up the tax code in the definitions of products and services within their databases, as well as for bundles, configurations, etc. Any entity that requires a tax-code association will have a tax-code-selection option.

|

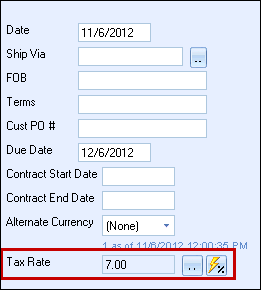

The Tax Rate field stores the tax rate for the quote. To change the sales tax rate, click ![]() next to the Tax Rate field. A Select tax rate lookup list will display, where you can click New to create an entry for each of the different sales-tax rates you’ll be using.

next to the Tax Rate field. A Select tax rate lookup list will display, where you can click New to create an entry for each of the different sales-tax rates you’ll be using.

When entering the tax rate into the lookup list, you can follow the rate with a “//”, then a description of the rate (like “LA County”). This makes it easier to find the correct tax rate to use for the quote. You can also use the DataLink feature with this field, so QuoteWerks can automatically pull the customer’s sales-tax rate from a field in the customer’s contact record.

You can specify a different tax rate for each quote. In addition, you can set a default tax rate for new quotes under Tools > Options. When you add products or services (collectively known as items) to the quote, sales tax will be charged on all items that were set up as taxable (see Creating and Maintaining Products and Services Databases for more information).

The sales tax due for this quote is listed on the bottom of the Document Items tab.

Note: The Real-time Module is required for the Tax Rate Lookup feature. |

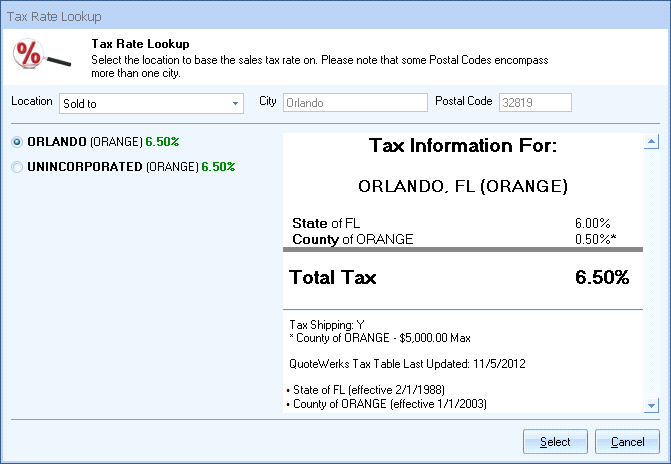

The Tax Rate Lookup displays the correct sales-tax rate based on the contact’s zip code and city, pulled from the Sold to / Ship to tab in the Quote Workbook.

Clicking ![]() under the Sale Info tab will launch the link between QuoteWerks and the QuoteWerks Content Server, and the Tax Rate Lookup window will display.

under the Sale Info tab will launch the link between QuoteWerks and the QuoteWerks Content Server, and the Tax Rate Lookup window will display.

The tax rates available for the current zip code will appear in a list, and the user can then select the appropriate rate.

You can also use the Location drop-down box to choose among the Sold to, Ship to, or Bill to zip codes to find the tax rate you’d like to use for the document.

You can set the default lookup location under Tools -> Options > Real-time tab -> Real-time Setup > Sales Tax tab. Using the drop-down box, set whether the tax rate will be based on the zip code from the Sold to, Ship to, or Bill to zip-code field.

The Tax Rate Lookup service also displays the date the QuoteWerks Tax Table was last updated. You can clearly see when the tax codes were updated in QuoteWerks. Also displayed are the effective dates of city, state, and county taxes. This is useful in determining exactly when new rates took effect.

Related Topics: