|

Selecting the Canadian Tax System

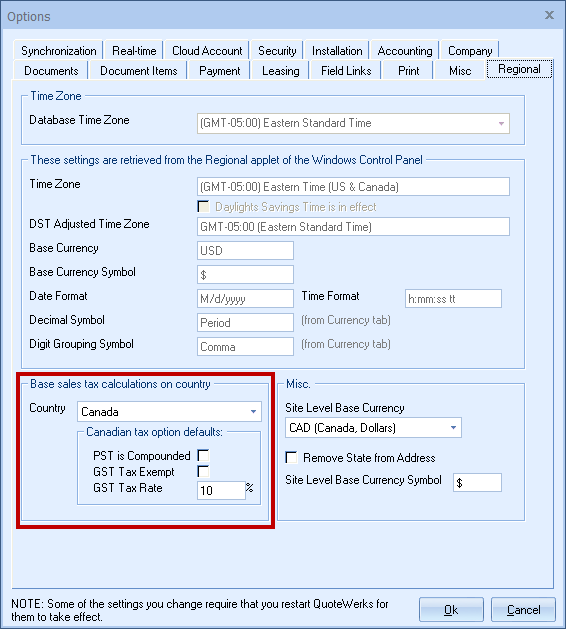

Under the Tools -> Options menu, select the Regional tab.

Select "Canada" from the Base sales tax calculations on country drop-down box.

Canadian Tax Option Defaults

PST Is Compounded

Check this option if you are in a region of Canada where PST tax is charged on the sum of the sale amount and the GST tax.

GST Tax Exempt

Check this option if you do not want to charge GST tax.

GST Tax Rate

You can enter the GST Tax Rate for your region. If you never charge GST tax, then just enter 0. This GST tax rate is applied to all quotes (orders and invoices too) unless you select the “GST tax exempt” option here or on the Sale Info tab of the Quote Workbook.

Note: These defaults can all be changed manually on a quote-by-quote basis on the Sale Info tab of the Quote Workbook. Also, you can choose the View -> Customize Columns menu to include the PST tax and GST tax columns for each line item in the quote on the Document Items tab. |

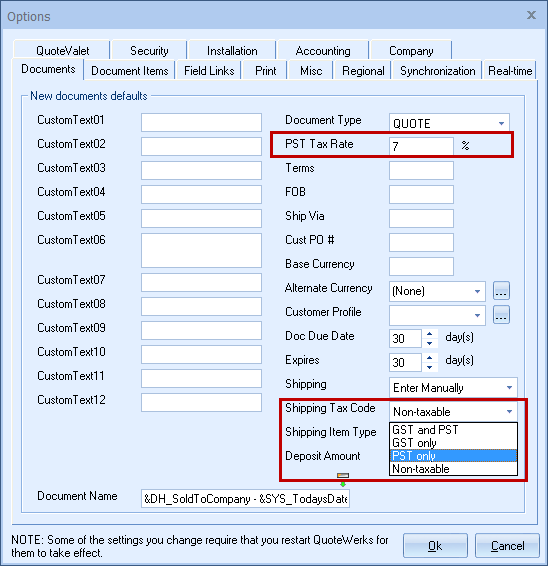

Documents Tab

PST Tax Rate

On the Documents tab, you can set the default PST tax rate for all new quotes in the PST Tax Rate field. This will be the default rate for new quotes, orders, and invoices.

Shipping Tax Code

On the Documents tab, you can set the default tax code for the shipping amount from the Shipping Tax Code drop-down box. When adding shipping to the quote, you can choose the Tax Code at that time.

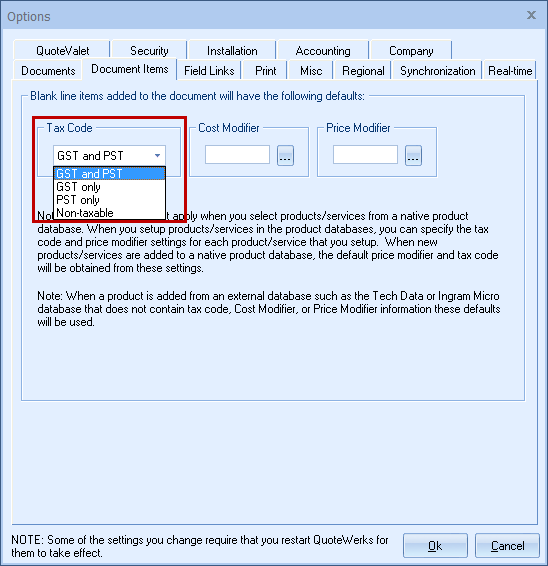

Setting the Default Tax Code

Under the Document Items tab, select the default Tax Code to be used for all line items added to the quote manually. So, for line items you add to the quote from a Product Data Source, the tax code will come from there.

Related Topics: