Important: The following is a very simplified explanation of the sales tax systems of the USA and Canada. It's meant to give you a general understanding of these systems, and may not be 100% comprehensive. This is not meant to be sales tax advice; please consult your accountant for sales tax advice. |

|

USA Sales Tax

Each state in the USA has different Sales Tax rules, rates, and requirements. Some are really simple and straight forward and some are very complicated. Generally speaking an item is either taxable or non-taxable and the sales tax is based on the selling price of the item.

Location

Generally speaking, Sales Tax is charged based on the location where the product is shipped to or services are performed. The Sales Tax collected and the rules for the amount collected comes down to knowing exactly where the location is, in terms of the State, County, and City.

You cannot base the Sales tax simply on the 5 digit zip code because zip codes can span more than one county and different counties have different Sales Tax rules. So bottom line, you need to know the zip+4 postal code like 32819-1234 or you need to know the street number and street name.

Rules

Each state in the USA has different Sales Tax rules, rates, and requirements. Some are really simple and straight forward and some are very complicated.

For states that have a simple sales tax system, when selling to a customer located at a particular address, your business would need to collect, for example, 6.00% sales tax for the State, and .5% for the county, for a combined amount of 6.5%. These states either collect sales tax on products and services, or only on products.

To calculate the total sales tax you need to collect from your customer you just add up the taxable amount of all the items and multiple by 6.5%, and round to the nearest penny. This is how QuickBooks Desktop calculated sales tax 30 years ago, and it is still how it calculates tax in 2024.

QuoteWerks is designed to calculate taxes this same way as it has been a standard and ensures that the sales tax QuoteWerks calculates will match the amount of sales tax that QuickBooks calculates when QuoteWerks exports an invoice to QuickBooks.

When the USA Sales tax system is selected, QuoteWerks does have a Sales Tax Amount column on the Document Items tab that will show the Sales tax calculated for that line item and rounded to 2 decimal places. This is only meant to display the sales tax amount to give you a sense of the sales tax amount, however the Total Sales tax for that quote is not calculated by adding up these rounded Line Item Sales tax values, but rather by multiplying the total taxable amount of all the line items by the aggregate sales tax rate, which often will be a few pennies different than added up the Rounded per line item Sales Tax amounts due to the rounding of each line item.

Selecting the USA Tax System

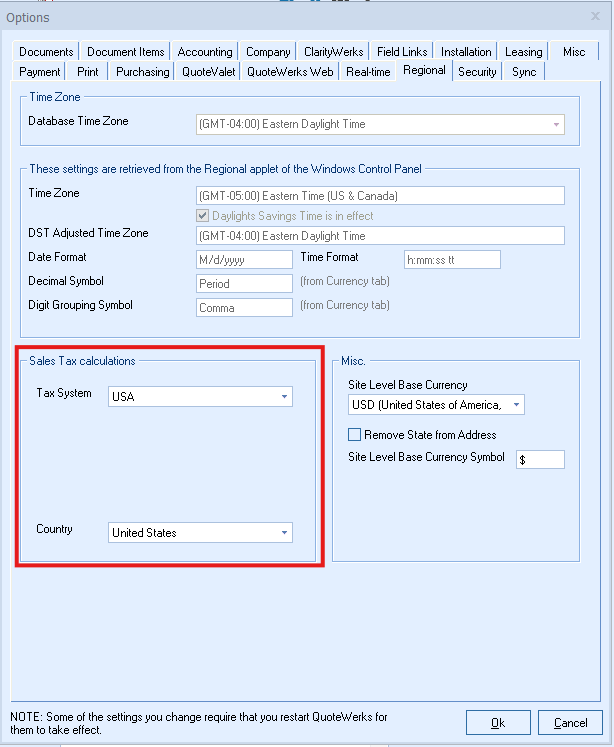

Under the Tools -> Options menu, select the Regional tab.

In the Sales Tax Calculations section select "USA" as the Tax System and "United States" as the "Country."

Setting the Default Tax Rate

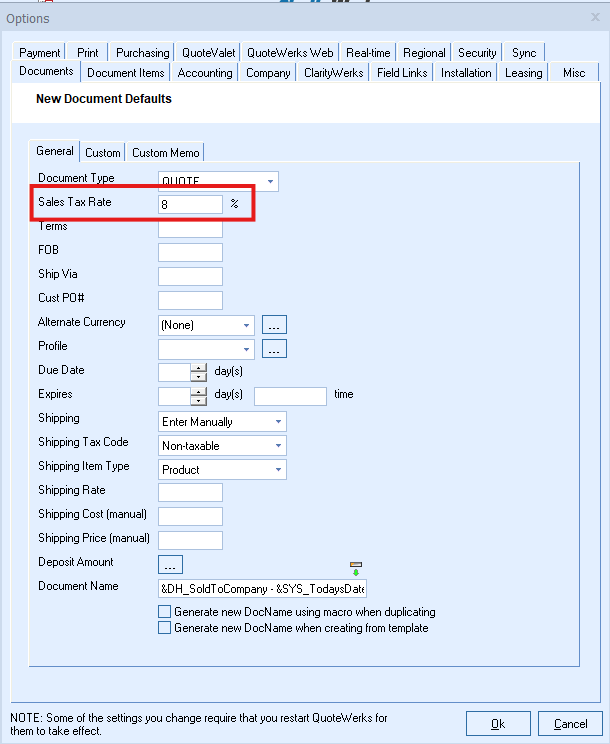

Under the Documents tab, in the Sales Tax Rate field, enter the most common sales tax rate you’ll be using when quoting. This will be the default rate that is used for all new quotes, orders, and invoices.

Under the Document Items tab, select the default Tax Code to be used for all line items added to the quote manually. So, for line items you add to the quote from a Product Data Source, the tax code will come from there.

Shipping Tax Code

On the Documents tab, you can set the default tax code for the shipping amount from the Shipping Tax Code drop-down box. When adding shipping to the quote, you can choose the Tax Code at that time.

Related Topics: