Important: The following is a very simplified explanation of the sales tax systems of the USA and Canada. It's meant to give you a general understanding of these systems, and may not be 100% comprehensive. This is not meant to be sales tax advice; please consult your accountant for sales tax advice. |

|

Canadian Sales Tax

Rather than an item being either taxable or non-taxable, the Canadian sales tax system has 4 tax codes, GST Only, PST Only, Both (GST and PST) or non-taxable. Generally speaking, the Canadian federal government charges its own tax (GST tax), and the individual Canadian provinces (states) also charge their own tax (PST tax). Some provinces charge their PST tax based on the sales price of the item PLUS the GST tax amount. This is called compounded tax. The sales tax is generally based on the selling price of the item.

The Canadian government also implemented a third tax (HST tax). This is a single blended combination of PST and GST taxes. This HST tax system is in use in some provinces.

Selecting the Canadian Tax System

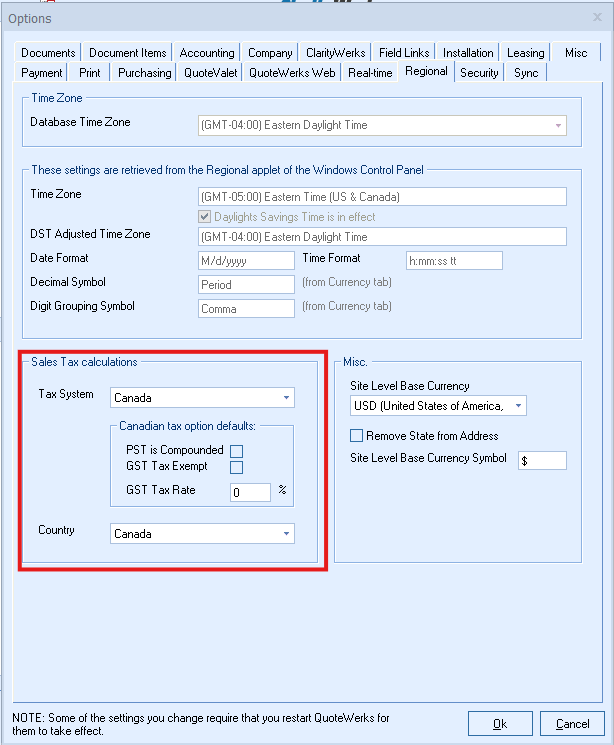

Under the Tools -> Options menu, select the Regional tab.

In the Base sales tax calculations on country area of the window select "Canada" from the drop-down box next to tax system and "Canada" from the drop-down box under country.

Canadian Tax Option Defaults

PST Is Compounded

Check this option if you are in a region of Canada where PST tax is charged on the sum of the sale amount and the GST tax.

GST Tax Exempt

Check this option if you do not want to charge GST tax.

GST Tax Rate

You can enter the GST Tax Rate for your region. If you never charge GST tax, then just enter 0. This GST tax rate is applied to all quotes (orders and invoices too) unless you select the “GST tax exempt” option here or on the Sale Info tab of the Quote Workbook.

Note: These defaults can all be changed manually on a quote-by-quote basis on the Sale Info tab of the Quote Workbook. Also, you can choose the View -> Customize Columns menu to include the PST tax and GST tax columns for each line item in the quote on the Document Items tab. |

Documents Tab

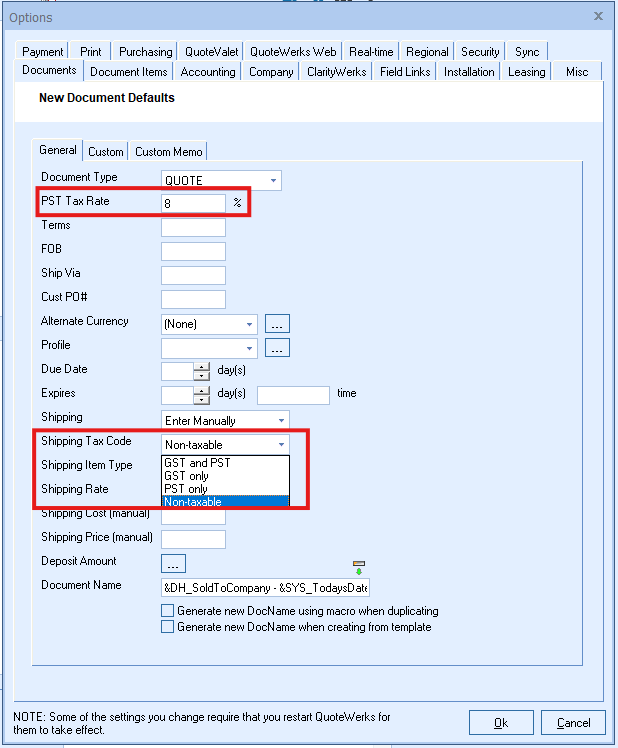

PST Tax Rate

On the Documents tab, you can set the default PST tax rate for all new quotes in the PST Tax Rate field. This will be the default rate for new quotes, orders, and invoices.

Shipping Tax Code

On the Documents tab, you can set the default tax code for the shipping amount from the Shipping Tax Code drop-down box. When adding shipping to the quote, you can choose the Tax Code at that time.

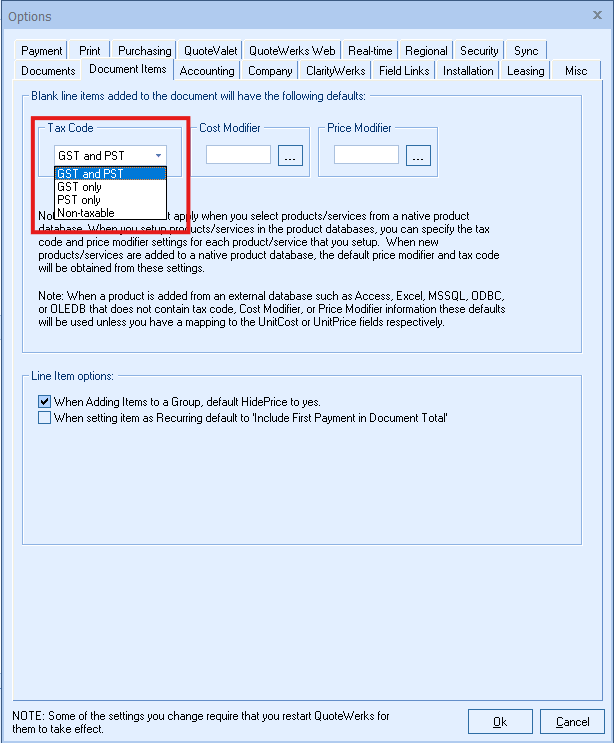

Setting the Default Tax Code

Under the Document Items tab, select the default Tax Code to be used for all line items added to the quote manually. So, for line items you add to the quote from a Product Data Source, the tax code will come from there.

Related Topics: