Sales Tax Item Name

The sales tax item is used to specify which sales tax rate your customer should be charged. Note, even if you do not charge or use sales tax, you MUST specify a sales tax item name. In QuickBooks you can set up different sales tax items to reflect the different tax zones. Most companies only need one zone (their own). ABC Company, Inc. is based in North Aurora, so we called the sales tax item “North Aurora”. If you sell to different counties or areas that require a different tax rate and are stored in QuickBooks as different tax agencies, before you export each QuoteWerks document to QuickBooks, you may need to adjust these tax settings. If there are several tax settings that you will be using, you can select the F2 key while in these tax fields to display a popup list to which you can add your commonly used tax settings.

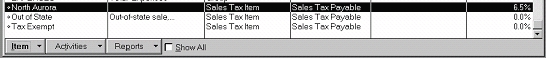

You can find the sales tax related information in QuickBooks by selecting Lists -> Item List menu, and scrolling down the list until you find some items that are a type of “Sales Tax Item”. For our example we have highlighted the “North Aurora” sales tax item in the screenshot below.

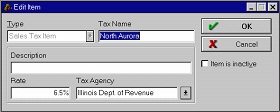

To edit the Sales Tax item click on the Item button and select Edit from the displayed menu. The edit item window will then appear:

Sales Tax Payable Account

The Sales Tax Payable Account is the account that you have setup in QuickBooks to track the sales tax that you have collected. You can find this information In QuickBooks by selecting the Lists -> Chart of Accounts menu. Typically the account type is “Other Current Liability”

![]()

Sales Tax Agency Name

The sales tax agency is also specified on this setup window. We have it setup as a vendor account type. The sales tax agency is the entity that we send the collected sales tax to. We send ours to the “Illinois Dept. of Revenue” tax agency. You can edit this information on the Edit Item window above.

For information on the next tab, see Item Creation Tab.