|

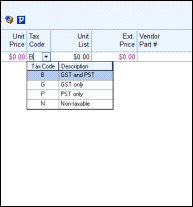

When creating a quote and adding products and services to the quote, you’ll see a Tax Code column in the Quote Workbook. This column displays the tax code being used for that particular line item. If you click in that column for a line item, a drop-down box will appear for you to select the appropriate tax code.

Tax Code Column

In the Tax Code column for each line item, you can type the tax code of "B" for GST and PST, "G" for GST only, "P" for PST only, and "N" for non-taxable. You can also choose these codes from the Tax Code drop-down box.

You can also set up the tax code in the definitions of products and services within their databases, as well as for bundles, configurations, etc. Any entity that requires a tax-code association will have a tax-code-selection option.

|

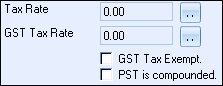

The Tax Rate field stores the tax rate for the quote. To change the sales tax rate, click ![]() next to the Tax Rate field. A Select tax rate lookup list will display, where you can click New to create an entry for each of the different sales-tax rates you’ll be using.

next to the Tax Rate field. A Select tax rate lookup list will display, where you can click New to create an entry for each of the different sales-tax rates you’ll be using.

When entering the tax rate into the lookup list, you can follow the rate with a “//”, then a description of the rate (like “LA County”). This makes it easier to find the correct tax rate to use for the quote. You can also use the DataLink feature with this field, so QuoteWerks can automatically pull the customer’s sales-tax rate from a field in the customer’s contact record.

You can specify a different tax rate for each quote. In addition, you can set a default tax rate for new quotes under Tools > Options. When you add products or services (collectively known as items) to the quote, sales tax will be charged on all items that were set up as taxable (see Creating and Maintaining Products and Services Databases for more information).

The sales tax due for this quote is listed on the bottom of the Document Items tab.

GST Tax Rate

GST Tax Exempt

You can choose not to charge GST for this quote

PST is compounded

You can choose whether PST should be compounded for this quote.

Related Topics: