Sales Tax Overview

Important: The following is a very simplified explanation of the sales tax systems of the USA and Canada. It's meant to give you a general understanding of these systems, and may not be 100% comprehensive. This is not meant to be sales tax advice; please consult your accountant for sales tax advice. |

Generally speaking, the sales tax charged on an item is based on the sale price of the item.

USA Sales Tax

In the USA, the sales tax system is pretty simple: Generally speaking, each state charges a single tax rate on products sold in that individual state, often slightly different by county. For example, Orlando charges 6.5% (6% goes to the state, and .5% goes to Orange County).

Canadian Sales Tax

The Canadian sales tax system is much more complicated. Generally speaking, the Canadian federal government charges its own tax (GST tax), and the individual Canadian provinces (states) also charge their own tax (PST tax). Some provinces charge their PST tax based on the sales price of the item PLUS the GST tax amount. This is called compounded tax.

The Canadian government also implemented a third tax (HST tax). This is a single blended combination of PST and GST taxes. This HST tax system is in use in some provinces.

Selecting the Sales Tax System to Use

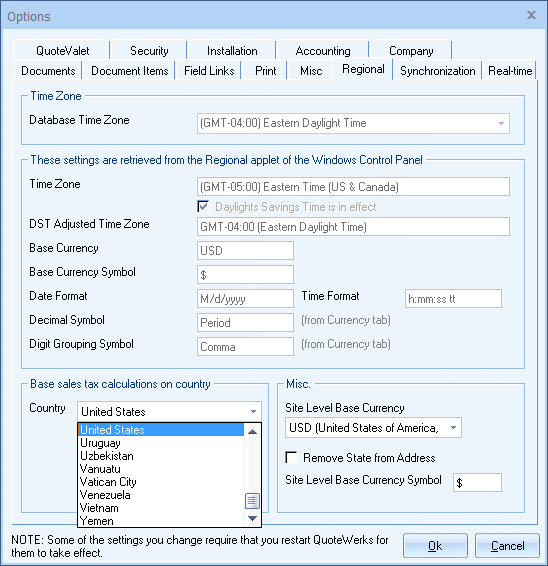

To set up the sales tax system, select the Tools -> Options menu, select the Regional tab.

From here, you can select to base the sales-tax system on the USA sales tax standards or the Canadian GST/PST tax standards.

|

For further information on setting up and using sales tax, as well as information about shipping calculations and cost, see the following topics:

●Setting Up Sales Tax (Canada)

●Using Sales Tax in a Quote (USA)