The invoice due date for the QuickBooks invoice is obtained from the Due Date field on the Sale Info tab of the Quote Workbook.

Here are some behaviors of the IIF link to be aware of:

●The link exports orders to QuickBooks as invoices or estimates. It cannot export orders to QuickBooks pending invoices.

●When importing invoices, QuickBooks does NOT automatically number the invoice, however a workaround exists by selecting the Activities -> Create Invoices (Customers -> Create Invoices in QuickBooks 2000) menu after you import the invoice into QuickBooks, then click on the next number, and enter the appropriate invoice number.

●QuoteWerks cannot export items to QuickBooks that are setup in QuickBooks to have sub-items.

●You can export your QuickBooks items to a file, and then import them into QuoteWerks. QuoteWerks does not directly read the QuickBooks product list.

●You can choose to have QuoteWerks create the items in QuickBooks Lists -> Items list when the invoice is exported. If that item already exists in QuickBooks, it will be replaced with the new information that you are exporting.

●You can specify a default item type (Service, Inventory Part, Non-Inventory Part) for the items that you export to QuickBooks. If you do not use the default, you can select the item type to use for each item that is exported.

●In QuickBooks Pro 2000, if an estimate number already exists in QuickBooks, and you try to import an estimate with the same estimate number an “Invalid Transaction” error will occur.

●When QuickBooks imports the invoice from QuoteWerks it uses the cost associated with the part # in QuickBooks. If you chose to export the item definitions with the invoice, the cost in QuoteWerks and the cost in QuickBooks will be the same. If you did not export the item definitions, the cost of the item in QuoteWerks could be different than the cost of the item in the item definition in QuickBooks. This is important to know because it could affect your Cost of Goods Sold reports. QuickBooks does use the price of the part # that was specified in QuoteWerks whether you export the item definitions or not. You can setup the cost for the part in QuickBooks by selecting the Lists -> Items menu.

●The sales tax line displayed on the invoice will always have the generic description of “Sales Tax”, rather than the description related to the particular sales tax item used.

●A sales tax line will appear with a zero amount if the items on your invoice are not taxable. To prevent the appearance of the zero amount on the printout select the invoice in QuickBooks after you import it, and select a different tax rate, then reselect the tax rate.

●If you export an estimate to QuickBooks 99 or earlier, and that estimate already exists for the customer, the existing estimate will be replaced with the new estimate you are importing into QuickBooks. If you are using QuickBooks 2000, an error will occur because QuickBooks 2000 does not allow you to import an estimate if an estimate of the same name already exists.

●The Customer Name and Job Name can each be a maximum of 41 characters in length. If you export an invoice/estimate to QuickBooks with a company name of greater than 41 characters, the company name will truncate at 41 characters.

Solutions to common issues:

●If any of the QuickBooks account names that you specify in the QuoteWerks setup do not exist, QuickBooks will create an account with the name that you specified as a BANK type account instead of appearing in your Accounts Receivable account. Often, this happens when you spell an account name incorrectly.

●If an invoice does not appear on the Open Invoices Report after you have imported that invoice into QuickBooks there is a problem with the Accounts Receivable account that you specified. You may have specified an incorrect account, or made a spelling error on the account name. Look in the “Deposits to Make” account. If you see an entry for the invoice amount, and incorrect account name was specified, so QuickBooks created a new account for it, and made it a BANK type account.

●If you do not check the box to export the customer information to QuickBooks, and the customer does not already exist in QuickBooks, QuickBooks will create an entry for this customer, but will classify it as an “Other Names” instead of “Customers”.

●If you select the wrong part # field (manufacturer or vendor) to pass to QuickBooks, when setting up the QuickBooks link, you may end up with a blank part # in the QuickBooks invoice, which will result in your cost of goods account not being incremented.

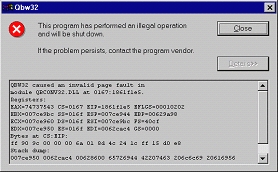

●When importing the IIF file into QuickBooks, you may receive an error message like the one below. If this message appears, check that you have correctly setup the sales tax account name and sales tax agency name in the QuoteWerks QuickBooks setup.

●If you export an estimate to QuickBooks, and the customer does not already exist in QuickBooks, and you did not choose the export option to export the customer definition, a vendor type of record will be created for the customer. This is a behavior of QuickBooks. The solution is to delete the incorrectly created vendor type of record from the Lists -> Vendors list, and then choose to export the customer definition when exporting the estimate, or make sure that the customer already exists in the QuickBooks Lists -> Customer:Job List menu.

●When importing the IIF file into QuickBooks, you may receive an error message like the one above. This message appears when the data in one of the fields that you are sending to QuickBooks contains more data than QuickBooks can store. The solution to the problem is to look at the quote that you exported to see if any of the data in the fields has more information in it than common sense may dictate. For example, in QuickBooks, the ship via field data can be no more than 15 characters long. If you fill out a ship via in the QuoteWerks document that is 50 characters long for example, you will receive this error when importing the IIF file.

●When importing the iif file into QuickBooks, if you receive the error message “Transaction split lines to accounts receivable must include a customer on that split line.”, then the company name used in the invoice is already in use by QuickBooks for something else. That same company name could be entered as a vendor, employee, other name, etc in QuickBooks. The solution is to change the existing company name that is being used in QuickBooks, or change the company name being used in the invoice.

Related Topics: